BCAF003: Business Accounting Assignment 1 Questions | TP

| Category | Assignment | Subject | Business |

|---|---|---|---|

| University | Temasek Polytechnic (TP) | Module Title | BCAF003: Business Accounting |

BCAF003 Assignment 1

Question 1 (3 Marks)

Part 1: Source documents are an important part of the accounting process. Refer to Lecture 2 APPENDIX L2/1.

Collect one source document from a business entity, e.g., a Singtel bill, TP receipt, etc., scan and paste it in the space below. The document’s date must be between December 2024 and May 2025.

Source Document

Scan and insert an image of the source document here:

Part 2: Assuming that you are a business entity that transacted and received the source document in Part 1, describe the effect of the transaction on your entity’s financial statements.

Question 2 (6 Marks)

GreenSphere Technologies began operating in 2023. It offers innovative energy management solutions and advisory services to promote sustainable practices and enhance energy performance.

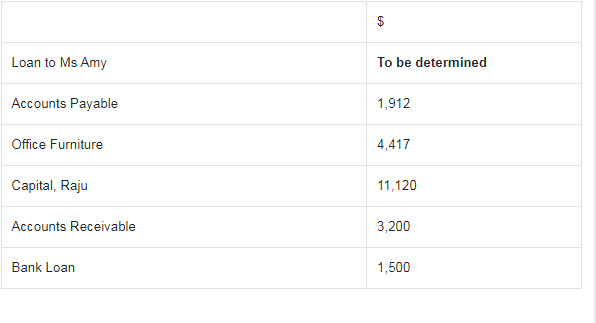

It ended its second financial year on 30 April 2025 with the following accounts:

Required:

- Compute the balance in the Loan to Ms Amy account as of 1 May 2025.

- Raju contributed $5,000 to the business on 14 May 2025.

Greensphere Technologies earned total revenue of $3,722 and incurred total expenses of $4,528 in May.

Compute the amount of owner’s equity as at 31 May 2025.

Do You Need Assignment of BCAF003 Assignment 1 Question

Order Non Plagiarized Assignment

Question 3 (36 Marks)

TasteTrail Markets is an online marketplace that connects local food artisans and farmers with consumers. It showcases fresh produce, homemade goods, and curated meal kits. The company focuses on supporting local communities and promoting sustainable food sourcing.

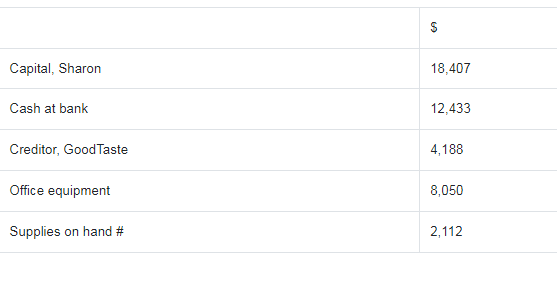

On 1 April, TasteTrail Markets had the following account balances with normal balances:

Supplies on hand consist of promotional food samples such as mini jars of sauces; seasonal freebies such as holiday-themed gift tags, and educational booklets on food sustainability and recipes.

The following events took place in April 2025:

| Date

Apr |

Transactions |

| 4 | The owner, Sharon, gave away 200 mini jars of sauces, worth $500, to promote the business. |

| 8 | The business purchased 1,000 Mother’s Day gift tags at $0.20 each. A 10% discount was granted by the supplier for cash payment. |

| 13 | The business paid GoodTaste $4,100 to settle the outstanding account fully. |

| 19 | The business organised a course specifically for local food artisans and farmers to equip them with practical skills to adopt sustainable practices. A total of $2,815 in cash was collected from participants, with an additional $1,780 still outstanding. A total of $1,020 worth of supplies was used in conducting the course. |

| 25 | The business paid $1,200 for rent. |

| 29 | TasteTrail Markets received widespread media exposure through local news features, boosting its brand recognition. Sharon believes this increased visibility has substantially enhanced the business’s influence and wishes to record this at $15,000. |

Question 3 (Continued)

Additional Information:

Sharon left a note to the accounts executive:

Required:

1. Select two events in April and illustrate how an accounting principle is applied in the treatment of each transaction.

Event 1 on __________ (fill in the date of transaction that you have chosen)

Accounting principle: _____________________________________________

Explain the principle: _____________________________________________

Application of principle to transaction: ________________________________

______________________________________________________________

______________________________________________________________

Event 2 on __________ (fill in the date of transaction that you have chosen)

Accounting principle: _____________________________________________

Explain the principle: _____________________________________________

Application of principle to transaction: ________________________________

______________________________________________________________

______________________________________________________________

2. Explain how each transaction in April affects the relevant accounts.

3. Prepare the trial balance as at 30 April 2025, incorporating all the effects of the April transactions