ABFA1164 Financial Accounting II CW1 Assignment Brief

PART A -General Information of ABFA1164

- Grouping for Coursework

The minimum number of students per group is 4 with maximum 6 members per group (from the same tutorial class). - Plagiarism Statement Declaration

All students MUST sign on the plagiarism statement (refer Part D – PLAGIARISM) and attach the original signed copy with the coursework. - A.P.A Referencing Method

A.P.A referencing shall be adopted for this coursework and you can get the copy of such format from Google Classroom. Kindly read, understand and comply with the requirement of such standard. - Deadline for Submission

Your written report must be submitted to your respective tutor not later than Friday, 1 April 2024, 9am.

For any late submission of coursework, students shall complete the Late Submission of Coursework Form (as attached on page 8) and attach it together with their coursework. The lecturer/tutor shall also acknowledge receipt in the form. - Grading

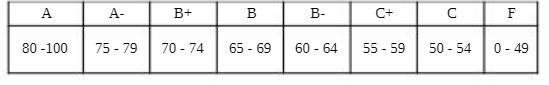

The total combined coursework 1 and 2 for this course is 100 marks and a student securing a minimum of 50 marks from the combined coursework 1 and 2 meet the minimum threshold marks in order to avoid repeating this course. A student who failed to meet the minimum coursework marks may need to pass a make good test.

Originality Report You are required to Turn-Inthe FINAL copy of the report to Turnitin. A percentage will appear indicating the figure you have plagiarised. An acceptable percentage for this course is not exceeding 20%.

Any group assignment with a percentage exceeding 20% has an option to redo with the aim of a lower percentage or being imposed a penalty deduction of 10 marks by the tutor concerned.

Get the Solution of ABFA1164 Assignment. Hire Experts to solve this assignment Before your Deadline

Order Non Plagiarized Assignment

PART B-Objective & Learning Outcomes of ABFA1164

- Objective

The objective of this coursework is to extend and refine students’ theoretical understanding in basic accounting, research methodology and teamwork. - Learning Outcomes

Upon successful completion of this coursework, students will be able to:

- Perform more thorough research from text, journals and websites from the library.

- Write and present report on research requirements as stated on Part C.

- Learn the A.P.A referencing method.

- Learn how to use Originality System.

PART C-Research Project of ABFA1164

1.Requirement

Write a well-research report of not more than 2,000 words but not less than 1000 words on the following topics:

- Discuss the types of inventories valuation method that allowed by MFRS102 Inventories. Support your answer by providing the usefulness and limitations of each of the valuation methods.

- Select a public company listed in Bursa Malaysia, extract the statement of profit or loss, statement of financial position, and relevant notes to accounts on inventories and receivables. Identify the inventory valuation method and accounting treatment for receivables adopted by your research company from its latest financial report. Discuss the following:

a. Advantages and limitations of the valuation method that adopted by your research company.(15 marks)

b.The two types of basic inventory control movements.(10 marks)

c.The accounting treatment for irrecoverable debts and allowance for receivables. - Encik Mansor operate a clothing business. He started a business by investing RM50,000 with which he purchased equipment for RM10,000.

Besides, Encik Mansor also spends RM4,500 to pay his house rental and maintained the remaining balance in the hand. Encik Mansor hire an accountant to help him in keeping the business records which will be prepare annually for the performance measurement and appraisal of financial position. He usually follows the accounting period start from 1 April of each year.

In the middle of the year, he purchased 5,000 pcs of fabrics at RM10 per piece and sold 4,300 pcs at RM15 during the accounting period. He paid a shop rent for RM1,200 per month for 10 months and paid RM45,000 to the suppliers of fabrics and received RM60,000 from the customers. By the end of the year, Encik Mansor bought stationery though not used fully in the accounting period and shown as an expense of that year.

Required: Identify and explain the accounting concepts in regards to Encik Mansor.